Sales Tax Not Calculating in Shopping Cart on WooCommerce: How to Fix

Last updated on June 2nd, 2025 at 01:03 pm

Introduction

For any online business based in the United States, collecting and applying sales tax correctly is not just important — it’s required by law. If your WooCommerce store is not calculating taxes properly, you could be losing revenue, breaking compliance rules, or creating a confusing experience for your customers.

Many WooCommerce users report similar problems. You might notice that taxes are not appearing at checkout, taxes are showing as 0%, or sales tax is completely missing from the cart page. These issues can affect product prices, shipping fees, and even how tax is calculated based on customer locations.

Unfortunately, these issues don’t always come with clear error messages. This leaves store owners wondering why WooCommerce tax is not calculating, or why the WooCommerce tax is not applied at checkout even when everything seems properly set up. The good news is that these problems are usually caused by common misconfigurations and can be fixed without custom development or code.

This guide will walk you through step-by-step solutions, plugin suggestions, and preventative tips to ensure your WooCommerce store calculates taxes the right way. First, let’s look at why these problems happen in the first place.

Why Sales Tax Might Not Show in WooCommerce

WooCommerce provides flexible tax settings, but that also means there are many places where things can go wrong. The most common reasons why WooCommerce tax is not showing in cart or WooCommerce tax is showing 0% often boil down to settings being missed or incorrect logic applied in the tax setup.

Let’s review the main causes of sales tax issues in WooCommerce:

- Taxes Are Not Enabled in WooCommerce

One of the first things to check is whether taxes are even enabled in your WooCommerce settings. Many store owners skip this option during the setup wizard. If it’s not turned on, no tax will be calculated, even if tax rates are entered correctly.

You can enable taxes by going to:

- WooCommerce → Settings → General

- Scroll down and check “Enable taxes and tax calculations.”

This is a small checkbox but a critical setting. Without it, none of the tax logic will activate.

- Tax Settings Are Incorrect or Incomplete

Once taxes are enabled, WooCommerce relies on accurate configuration to apply them. If your settings do not include proper rounding rules, display preferences, or location-based tax logic, you may see errors at checkout. This can lead to WooCommerce tax not being applied to shipping, or WooCommerce tax not being displayed on product pages.

- Address Not Triggering Tax Calculation

WooCommerce calculates tax based on customer location. If a shopper hasn’t entered their address or the system isn’t recognizing it, the tax won’t apply. That’s why many users report WooCommerce tax not updating after address input. This usually means the system didn’t trigger a refresh when the address was entered, or there’s a conflict with JavaScript or caching.

- Automated Taxes Not Working

If you’re using automated tax tools like WooCommerce Services or Jetpack, they can sometimes fail due to syncing issues or API limits. In this case, your store may show 0% tax or miss it entirely. You’ll want to test your connection or consider using a third-party plugin like TaxJar or Avalara for better reliability.

- Plugin or Theme Conflicts

Another common issue is plugin or theme conflict. Some themes or checkout plugins interfere with WooCommerce’s tax logic, preventing taxes from displaying or updating. This is a key cause of WooCommerce tax plugin conflicts and unexpected cart behavior.

Core Troubleshooting Steps to Fix WooCommerce Tax Issues

If sales tax is not showing in your WooCommerce cart or checkout, the issue usually lies in the settings. This part of the guide walks you through the most essential troubleshooting steps. These steps fix many common problems like WooCommerce tax not applied at checkout, WooCommerce tax not displaying on product pages, or WooCommerce tax not updating after address input.

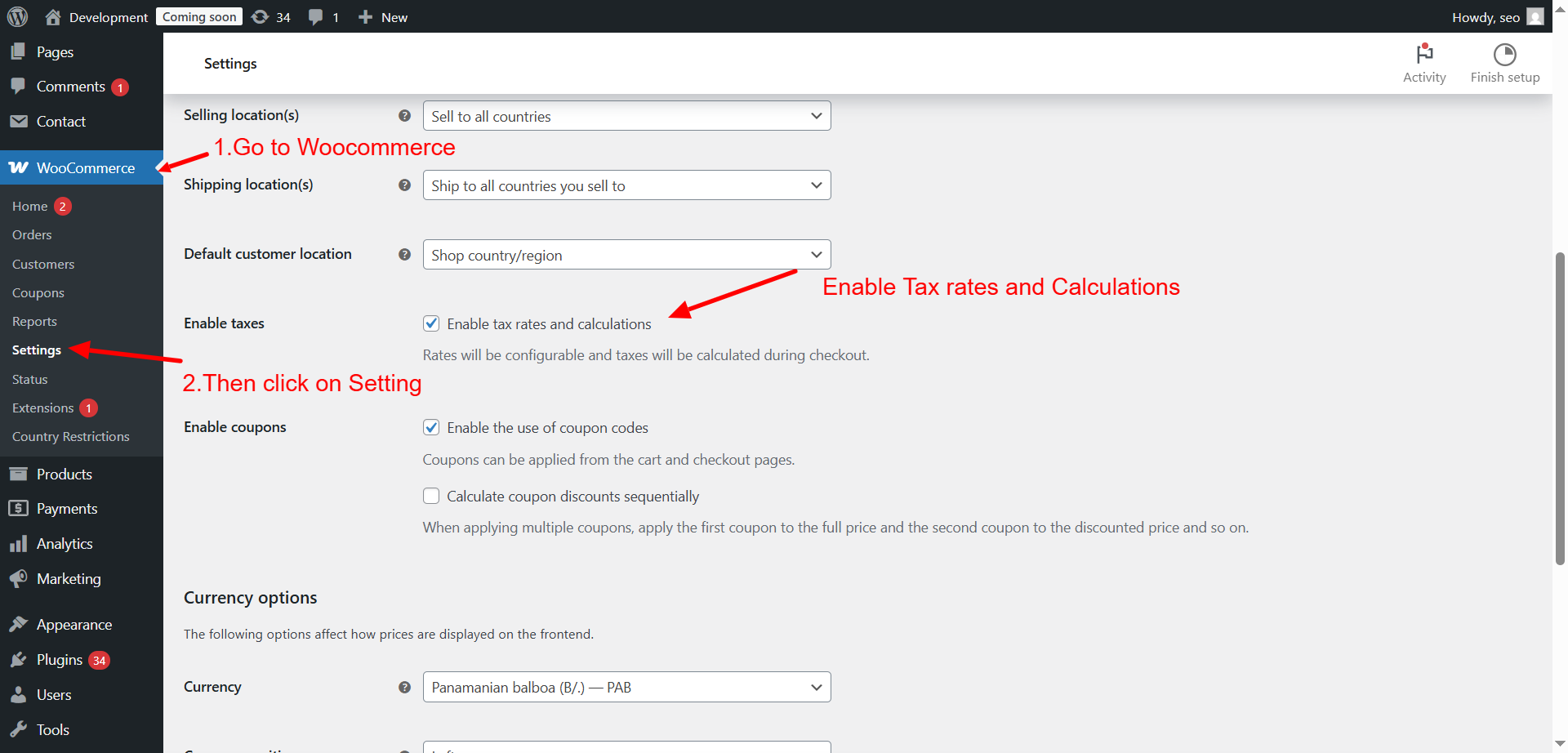

Step 1: Check if Taxes Are Enabled in WooCommerce

One of the most common reasons for WooCommerce tax not calculating is that taxes are simply not enabled in the settings. Even if you’ve set up tax rates or installed tax plugins, WooCommerce won’t apply taxes unless this checkbox is selected.

Here’s how to check:

- Go to WooCommerce → Settings → General

- Find the option “Enable taxes and tax calculations.”

- Make sure it is checked

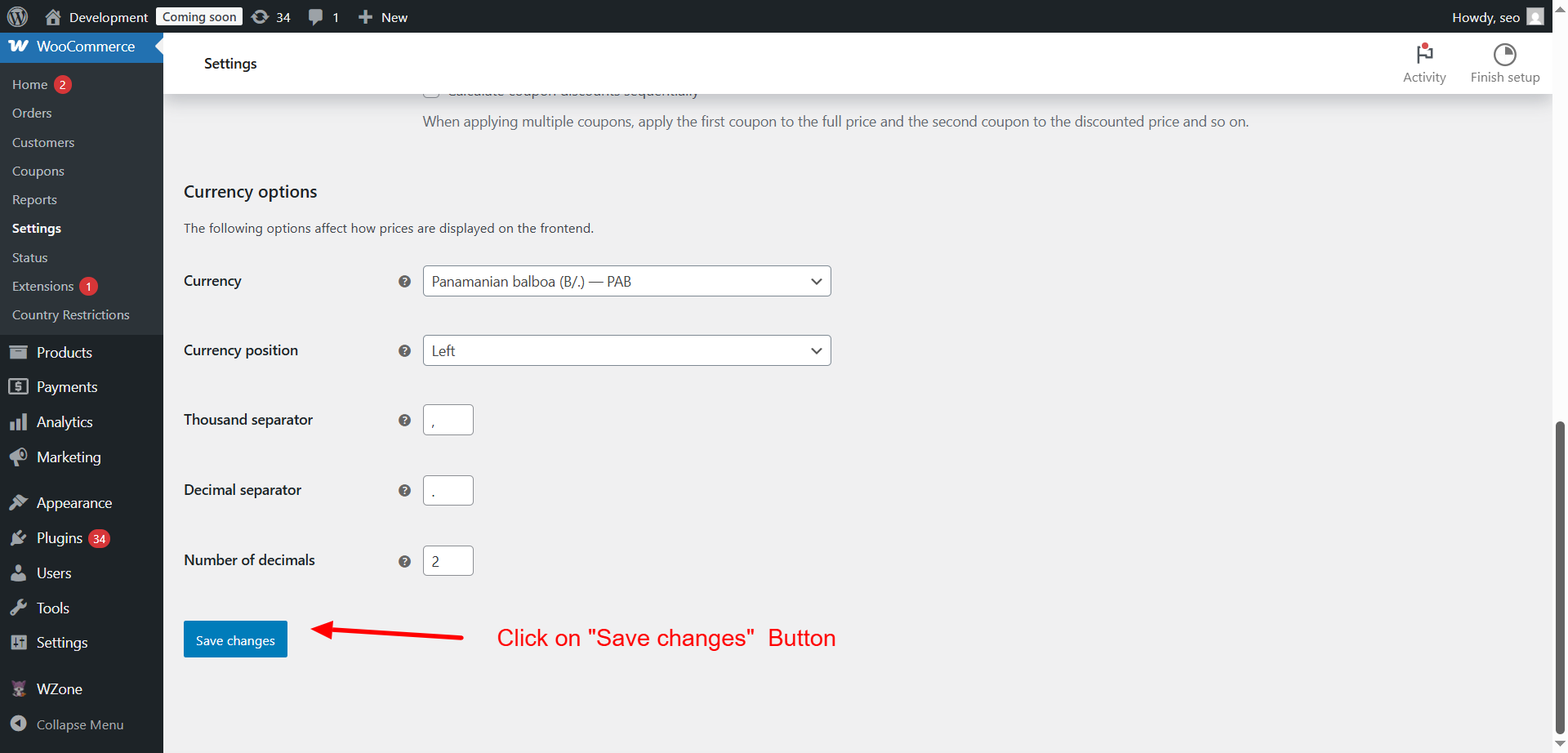

- Click Save changes

If this option is not enabled, tax will not show on product pages, carts, or checkout. This small setting is often overlooked, especially during the initial store setup.

Once taxes are enabled, you will see a new “Tax” tab in the settings. That’s where all your tax rules and rates live.

Step 2: Verify WooCommerce Tax Settings Configuration

Now that taxes are turned on, you need to configure how they behave. WooCommerce offers several options that control when and how taxes are shown and calculated. If these aren’t set correctly, you’ll continue to see WooCommerce sales tax issues like wrong tax amounts or no tax at all.

Here’s what you need to review:

- Prices Entered With Tax

- Choose whether your product prices include tax or not.

- For most U.S. stores, it’s better to select “No, I will enter prices exclusive of tax.”

- Calculate Tax Based On

- Choose the address WooCommerce should use for tax calculation.

- Select Customer shipping address to follow U.S. tax law best practices.

- Shipping Tax Class

- Set whether shipping gets taxed like the product or separately.

- Choose “Based on cart items” unless you have specific rules.

- Rounding

- Enable Round tax at subtotal level, not per line.

- This avoids minor rounding errors and improves checkout totals.

- Display Prices In The Shop / Cart / Checkout

- Set this based on your pricing style.

- U.S. stores usually show prices without tax on product pages.

- But you should show tax during checkout for transparency.

- Display Tax Totals

- Choose whether to show tax as a single total or itemized.

- Itemized can help if different products have different tax rates.

Check these settings in WooCommerce → Settings → Tax. Make sure everything aligns with your store location, pricing method, and customer expectations.

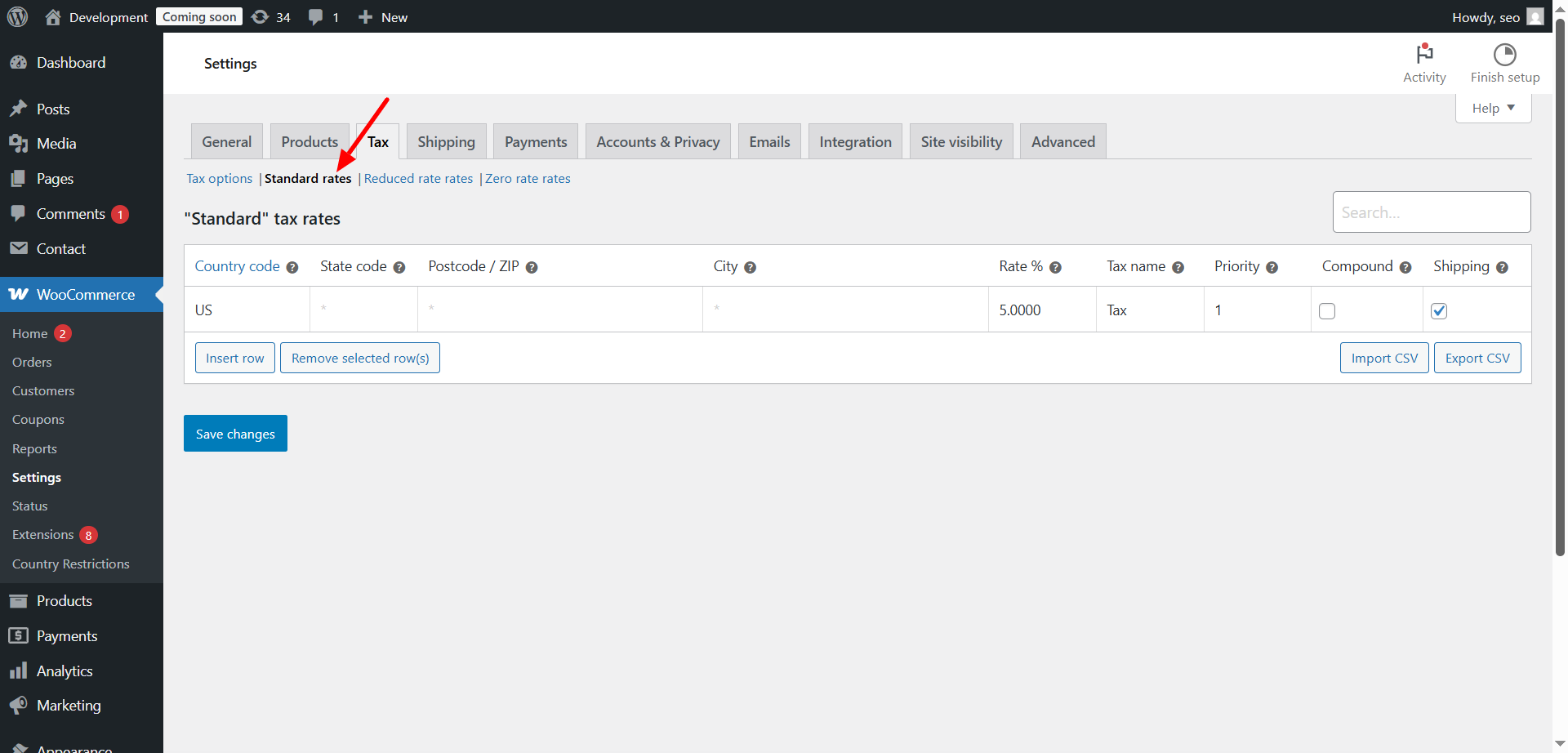

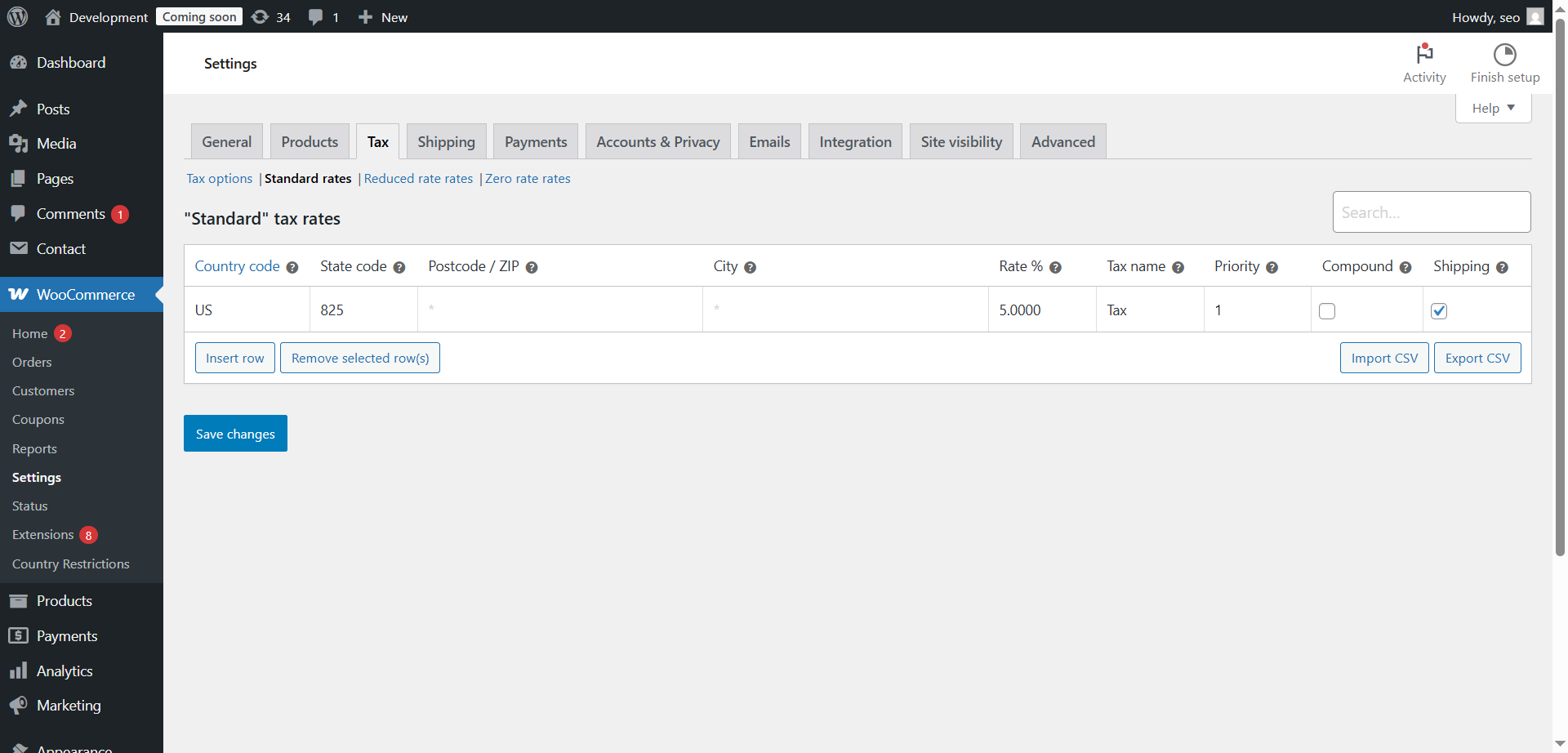

Step 3: Review Your Tax Rate Setup

If taxes are still not working, the problem may be with your tax rates. Even if taxes are enabled and configured, WooCommerce won’t apply any tax unless you’ve added valid rates for the zones you sell in.

Here’s how to review tax rates:

- Go to WooCommerce → Settings → Tax → Standard Rates

- Click Insert Row to add a new rate if needed

- Add the following details:

- Country code (like US)

- State code (like NY or CA)

- Rate (for example, 8.25 for 8.25%)

- Tax name (e.g., Sales Tax)

- Check Shipping if you want to apply tax to shipping

If these rates are blank or don’t match your customer’s state, WooCommerce won’t apply tax. This explains why WooCommerce tax not applied to shipping or tax shows 0% during checkout.

You can also import rates from a CSV file if your store covers many U.S. states. Always test your changes with a real product and address.

Step 4: Troubleshoot Automated Taxes Not Working

Many WooCommerce stores rely on automated tax tools like WooCommerce Services. These tools use services like Jetpack to calculate taxes based on location. However, if something goes wrong in the background, the tool may stop working.

Here’s how to check and fix it:

- Go to WooCommerce → Settings → General

- Make sure your store address is complete and accurate

- Go to WooCommerce → Settings → Tax → Automated taxes

- Check that the setting “Enable automated taxes” is on

Also, make sure you have Jetpack installed and connected. If the connection breaks, WooCommerce cannot fetch tax data.

Common issues with automated taxes include:

- Tax shows as 0%

- Tax not applied after entering an address

- Delayed or incorrect location-based calculations

To fix this, try disconnecting Jetpack and reconnecting it. You can also consider switching to a plugin like TaxJar or Avalara if WooCommerce Services is unreliable for your store.

Step 5: Check Product Tax Class Configuration

Each product in your WooCommerce store must be assigned a tax class. If a product has the wrong or blank tax class, tax will not be applied during checkout.

To check this:

- Go to Products → All Products

- Click Edit on one of your items

- Scroll down to the Product data section

- Under Tax class, choose Standard, Reduced rate, or another correct option

If the tax class is set to “Zero rate,” tax won’t apply. This can lead to issues like:

- WooCommerce tax not displaying on product pages

- WooCommerce tax is not applied at checkout

- Tax is being skipped even when address is correct

Make sure all products have the right tax class, especially if you import items using CSV or use external inventory systems.

Step 6: Identify Plugin Conflicts and Theme Issues

Sometimes, tax issues are not caused by settings or products. Instead, they come from conflicting plugins or themes that interfere with WooCommerce functions.

Common plugins that can cause tax problems:

- Custom checkout or cart plugins

- Shipping method plugins

- Currency switchers

- Caching or speed optimization plugins

These plugins may block WooCommerce scripts or override tax calculations. To test for conflicts:

- Disable all plugins except WooCommerce

- Switch to a default theme like Storefront

- Check if the tax issue goes away

If the tax starts working, you know one of your plugins or themes is the cause. Re-enable each plugin one at a time to find the conflict.

Also, clear your browser and site cache after testing. Many users report that WooCommerce tax not updating after address input is caused by old cached scripts.

Step 7: Clear Cache and Update WooCommerce Database

Even if all settings are correct, caching can prevent tax changes from appearing. Your store might still show outdated tax rules, especially after updates.

Here’s what to do:

- Clear cache from your caching plugin (e.g., W3 Total Cache, WP Super Cache)

- If using Cloudflare, clear cache from your Cloudflare dashboard

- Go to WooCommerce → Status → Tools

- Click Update WooCommerce database if available

After clearing the cache and updating the database, recheck your cart. In many cases, this solves display problems where WooCommerce tax not calculating or tax not showing in cart.

Top 5 Plugins to Fix WooCommerce Tax Issues

Plugins can solve complex problems like multi-state taxes, address-based rules, or automated updates. If WooCommerce tax is not calculating or your current setup is failing, these tools offer practical solutions.

- WooCommerce Services (Jetpack)

This is the default solution from WooCommerce for automated tax calculation in the U.S. It uses real-time data based on customer location.

Key Features:

- Calculates tax rates automatically

- Uses Jetpack to fetch accurate rates

- Free for basic usage

Why Use It:

It’s simple, free, and works directly with WooCommerce. However, it requires a stable Jetpack connection. If you’re already using Jetpack, it’s a good starting point.

- TaxJar for WooCommerce

TaxJar offers powerful U.S. tax automation, especially for businesses selling across multiple states. It integrates smoothly with WooCommerce.

Key Features:

- Automatic tax calculation for every U.S. state

- Monthly tax reports and filing support

- Handles marketplace facilitator laws

Why Use It:

TaxJar is best for medium to large stores. It simplifies sales tax filing and supports tax rules in all U.S. states. It also works well with subscription and marketplace models.

- Avalara AvaTax

Avalara is a premium tax platform built for accuracy and compliance. It suits businesses that sell in states with complex tax laws.

Key Features:

- Calculates tax based on product types and addresses

- Validates addresses to improve accuracy

- Offers return filing and tax exemption certificates

Why Use It:

Avalara is ideal for enterprise-level businesses needing full control. It’s more advanced than TaxJar and handles detailed tax requirements.

- Simple Sales Tax

This free plugin connects your WooCommerce store with TaxCloud to manage U.S. sales tax. It’s a great alternative to Jetpack.

Key Features:

- Calculates U.S. sales tax automatically

- Supports destination-based tax rules

- Files tax returns in supported states

Why Use It:

Simple Sales Tax is budget-friendly and reliable. If Jetpack or TaxJar don’t fit your needs, this is a strong option.

- WooCommerce EU/US VAT Compliance Assistant

Although originally built for VAT, this plugin now supports U.S. sales tax features too. It helps with customer location validation and tax record keeping.

Key Features:

- Validates customer location for compliance

- Stores tax evidence for audits

- Works with digital and physical products

Why Use It:

This is useful if you sell to both U.S. and international buyers. It supports mixed tax models and is great for digital stores.

Prevention Tips: How to Avoid WooCommerce Tax Issues

Fixing your tax setup is important, but preventing future problems is even better. Use these tips to keep your store working smoothly:

- Test your checkout monthly with different addresses

- Review product tax classes when adding new items

- Avoid using multiple tax plugins at once

- Clear your site cache after tax setting updates

- Keep WooCommerce and plugins updated to the latest versions

- Use staging environments to test major changes safely

These steps will help you avoid problems like:

- WooCommerce tax not displaying on product pages

- WooCommerce tax not applied to shipping

- WooCommerce tax calculation problems due to plugin conflicts

Benefits of Correct WooCommerce Tax Configuration

A well-configured tax system offers more than just legal compliance. It brings real benefits to your business and your customers.

- Compliance with State Tax Laws

U.S. tax law varies by state and even by city. Using correct settings helps you follow the rules and avoid penalties.

- Fewer Cart Abandonments

When tax appears clearly at checkout, shoppers trust your site more. Surprises in the total cost often cause people to leave the cart.

- Faster and Simpler Bookkeeping

With automated taxes and reporting, your monthly reports become easier to manage. Tools like TaxJar and Avalara offer downloadable records and filing options.

- Improved Customer Trust

Displaying tax correctly builds confidence. Customers see you as a reliable and professional seller.

- Better Shopping Experience

A smooth checkout, with clear pricing and accurate totals, creates a better experience. This can increase repeat customers and reduce support requests.

Conclusion

Tax problems in WooCommerce can be frustrating, especially for U.S. stores. Customers expect clear totals, and states require accurate collection. If taxes don’t show or show wrong, it affects both trust and legal compliance.

You’ve now seen the most common causes and fixes. From checking settings to using plugins like TaxJar or WooCommerce Services, solutions are available. Still, some problems may go beyond basic setups or become harder to solve alone.

That’s where expert help can make a real difference.

If your store is still facing sales tax issues, don’t worry — you’re not alone. WooCommerce setups can become complex, especially when dealing with:

- Multi-state tax rules

- Custom shipping rates

- Third-party plugin conflicts

Let the experts handle it. 24×7 WP Support offers:

- Quick troubleshooting for tax problems

- Plugin configuration and conflict resolution

- Complete WooCommerce tax setup for U.S. businesses

Their team is available anytime to help store owners get back on track fast. Whether you’re missing taxes at checkout or need to set up state-specific rates, their professionals can fix it for you.

💡 Tip: Don’t risk compliance or lose customers over small issues. A quick review by 24×7 WP Support can save hours of stress and lost sales.

Frequently Asked Questions (FAQs)

Q1: Why is WooCommerce not calculating tax at checkout?

Last updated on June 2nd, 2025 at 01:03 pm

A: Most likely, taxes are disabled, or the address isn’t triggering the rule.

Q2: Do I need a plugin to calculate U.S. tax?

Last updated on June 2nd, 2025 at 01:03 pm

A: Not always, but plugins like TaxJar or Jetpack help automate complex setups.

Related posts:

How to Fix WooCommerce Checkout Blocked Due to Shipping Address

How to Fix Checkout Submit Button Not Responding in WooCommerce

Fix WooCommerce Credit and Debit Card Declined Checkout Issue

Lost password link not working at WooCommerce checkout

Why Stripe Failed to Capture/Refund Payments in WooCommerce

Q3: Can I apply tax based on customer location?

Last updated on June 2nd, 2025 at 01:03 pm

A: Yes. WooCommerce lets you calculate tax based on the shipping or billing address.

Q4: What if tax shows 0% even with a valid address?

Last updated on June 2nd, 2025 at 01:03 pm

A: Check your tax rates, product tax class, and automated plugin sync.

Related posts: